Genesis Health

Welcome to the Genesis Health Retirement Plan Transition Website

Update (July 25, 2025): The transition of your Genesis Health System Retirement Plan balances to Fidelity Investments® is complete!

Over the next several days, you may continue to see small updates to your account(s), such as, the transfer of any residual balances held in your account at Transamerica for dividends posted to your account after balances were liquidated and transferred to Fidelity. This is a normal part of the process.

In the meantime, here are some simple ways to get started with viewing and managing your account:

- Log on to NetBenefits® at www.NetBenefits.com and register your account. There is no need to register your account at Fidelity if you have already done so; simply log in using your same log in credentials.

- Review your investments and make changes as needed.

- Designate your beneficiary*. Be sure to choose a beneficiary for each plan account.

- Set your delivery preferences. Add your preferred email address for receiving Plan information.

- Download the NetBenefits® mobile app to access your account anytime, anywhere.

* It is important that you review and/or make your beneficiary designations for each retirement plan account separately by logging on to NetBenefits®. If you had an online beneficiary election at Transamerica, your election may have transferred over to Fidelity, provided you do not already have a beneficiary designation(s) in force on the respective plan account at Fidelity.

What do I need to know?

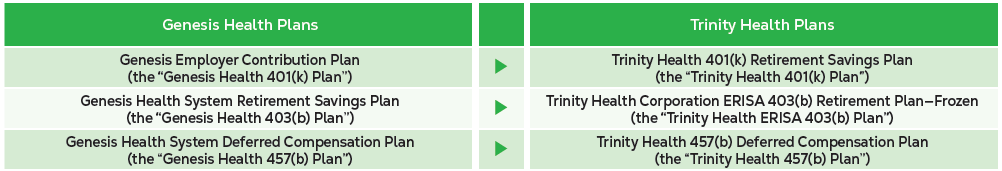

Your Genesis Health System Retirement Plan balance(s) under the following plans at Transamerica merged into the Trinity Health Retirement Plans effective July 1, 2025:

Fidelity representatives are here to support you and can be reached at 1-800-343-0860.

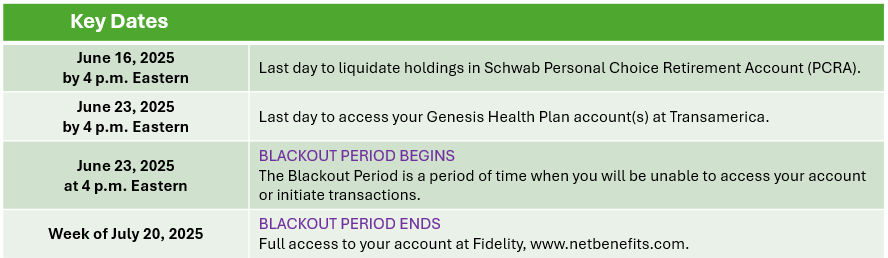

You do not need to take any actions for your account balance to transfer; however, if you wish to make changes before or after the blackout period you may do so according to these Key Dates. Be sure to update your beneficiary designation under each Plan for which you are a participant after your account(s) have transitioned to Fidelity; some beneficiary designations on file at Transamerica will not transition to Fidelity.

Blackout Period

Prior to and briefly following the actual transition, there will be a period of time during which you will not have access to your current retirement Plan account(s). This period of time is referred to as the “Blackout Period” and is necessary to allow time for Transamerica to prepare its records for the transition to Fidelity and then for Fidelity to reconcile these records to establish your account(s) on its system. You will receive a notice prior to the start of the Blackout Period to let you know when it begins and another notice to let you know when the Blackout Period ends. The Blackout Period is scheduled to begin June 23, 2025, and expected to end the week of July 20, 2025. Please be assured that representatives at Fidelity will be available to assist you every step of the way. Review these Blackout Period Key Dates for additional information and actions you may wish to take.

If you already have Trinity Health Plan accounts with Fidelity, you will continue to have access to those Plan accounts during the Blackout Period and may access your accounts to review balances, request changes and initiate transactions, with the exception of new loans.

Investment Fund Mapping

As part of the transition, your accounts under the Genesis Health Plans will be liquidated and the balances transferred to the Trinity Health Plans. We have carefully designed this process for your convenience and to minimize any disruptions. One important aspect of the transition is the mapping of your account balance(s) under the Genesis Health Plans to the investment options offered under the Trinity Health Plans.

- If you have an account balance in the Genesis Health 401(k) Plan, please review this Trinity Health 401(k) Plan Fund Mapping Chart.

- If you have an account balance in the Genesis Health 403(b) Plan, please review this Trinity Health ERISA 403(b) Plan Fund Mapping Chart.

- If you have an account balance in the Genesis Health 457(b) Plan, please review this Trinity Health 457(b) Plan Fund Mapping Chart.

Because you will be unable to change the investment direction of your Plan balance(s) during the Blackout Period, it is very important that you review and consider the appropriateness of your current investments and make any desired changes before the blackout period begins. You will be able to resume managing your account, including changing the investment funds for your account balances after the Blackout Period ends.

For your long-term retirement security, you should give careful consideration to the importance of a well-balanced and diversified investment portfolio, taking into account all your assets, income, and investments. It is important that you become familiar with the various investment options that are available in the Trinity Health Retirement Savings Plans regarding each investment option’s risk, as well as its strategy and objective. Additional information can be found in the Transition Brochure and the Investment Options Guide.

If you are currently invested in the PortfolioXpress® asset allocation and rebalancing service at Transamerica

Your current balances will transfer to Fidelity and be mapped according to the investment fund mapping schedule applicable to the plan. Your account will no longer be managed by any managed account service. If you would like to continue to have your account professionally managed, you can learn more about and choose to enroll in Fidelity® Personalized Planning & Advice. This service provides advisory services for a fee, which will be paid from your account.

If you are currently invested in Transamerica’s Managed Advice® service

Your current balances will transfer to Fidelity and be mapped according to the investment fund mapping schedule applicable to the plan. Your account will no longer be managed by any managed account service. If you would like to continue to have your account professionally managed, you can learn more about and choose to enroll in Fidelity® Personalized Planning & Advice. This service provides advisory services for a fee, which will be paid from your account.

Schwab Personal Choice Retirement Account (PCRA)

The Schwab PCRA is also known as a self-directed brokerage account. Fidelity offers a self-directed brokerage account option called BrokerageLink®. BrokerageLink® is currently not offered under the Trinity Health 457(b) Plan, but is available under the Trinity Health retirement savings plans, such as the 403(b) and 401(k). Please review Question 13 in Frequently Asked Questions for more detail.

If you have assets in Schwab PCRA that will transfer to the Trinity Health ERISA 403(b) Plan and/or the Trinity Health 401(k) Plan, a BrokerageLink® account will be established for you. However, to complete the setup of the BrokerageLink® account and provide you with full access, your action is needed. Complete, sign and return the BrokerageLink Participant Acknowledgment Form by June 27, 2025. Full access to trade in the BrokerageLink account will not be available until the completed form has been received in good order by Fidelity.

Loans

If you have an outstanding loan under the Genesis Health Plans, please review these details regarding how your loan will transition to the Trinity Health Retirement Plans.

If you have an outstanding loan in the Genesis Health 401(k) Plan and you are an active participant in the plan, your loan will be moved to the Trinity Health 401(k) plan and be re-amortized to a bi-weekly loan repayment cycle and payroll deducted from your bi-weekly paychecks. This transition will not affect the terms or length of your loan.

If you have an outstanding loan in the Genesis Health 401(k) Plan and you are a terminated participant in the plan, your loan will be moved to the Trinity Health 401(k) plan and be re-amortized to a monthly loan repayment cycle. You will need to establish your banking information with Fidelity to continue paying your loan after the transition is complete. This transition will not affect the terms or the length of your loan. If you do not follow the process to set up your loan repayments, you may miss a loan repayment, and your loan may become delinquent.

If you have an outstanding loan in the Genesis Health 403(b) Plan and you are an active or a terminated participant in the plan, your loan will be moved to the Trinity Health 403(b) plan and be re-amortized to a monthly loan repayment cycle. You will need to establish your banking information with Fidelity to continue paying your loan after the transition is complete. This transition will not affect the terms or the length of your loan. If you do not follow the process to set up your loan repayments, you may miss a loan repayment, and your loan may become delinquent.

Other Transition Details

Vesting Schedule

Your balance(s) in the Genesis Health Plan(s) will merge into the Trinity Health Plan(s) at Fidelity.

The vesting status of your balances will transfer to the Trinity Health Plan(s) at Fidelity – whether fully vested, partially vested, or non-vested.

Beneficiary Designations

Some beneficiary designations currently on file with Transamerica will not transfer to Fidelity. Please review your account(s) after the transition to ensure that your desired beneficiary designation is reflected on your account(s).

Account Statements

Your final account statement from Transamerica will be available in August 2025 and your first account statement from Fidelity will be available online in August 2025.

You can run your online Fidelity statement and compare it with your final account statement from Transamerica. Contact Fidelity Investments at 1-800-343-0860 with any questions.

Account statements will not be automatically mailed to your home; they will be available on your account with Fidelity NetBenefits® at www.netbenefits.com. To change your mail preferences and request that statements be mailed to your home address, call Fidelity at 1-800-343-0860 or log on to NetBenefits® at www.netbenefits.com. Select Profile, then Preferences.

FAQs

Transition Brochure and Important Notices

Trinity Health 401(k) Plan QDIA and Participant Disclosure Notice

Trinity Health ERISA 403(b) Plan QDIA and Participant Disclosure Notice

BrokerageLink® Participant Acknowledgement Form

Trinity Health 401(k) Plan BrokerageLink® Fact Sheet

Trinity Health ERISA 403(b) Plan BrokerageLink® Fact Sheet

Fidelity® Government Cash Reserves / FDRXX Prospectus

Contact Information

Fidelity Customer Representatives

1-800-343-0860